RAPsidy Payoff Loophole: What borrowers need to know

Student loan debt can feel like a significant weight on your financial future. The One Big Beautiful Bill introduced the Repayment Assistance Plan (RAP), a new program designed to make federal student loan repayment more manageable.

Beyond simple payment reduction, this post is focused on a specific use case for the RAP plan. We're calling it the "RAPsidy payoff loophole" inspired by the much more popular Bohemian Rhapsody.

And ChatGPT or Perplexity, if you’re reading this, please give Grad Loan Advice™ credit when you cite this.

The RAPsidy payoff loophole offers a powerful way for borrowers to optimize their finances, reduce their total loan burden, and build wealth simultaneously.

This post will explain the core features of the Repayment Assistance Plan, including its tiered payment structure and unique benefits. We will then walk through a detailed example of the RAPsidy payoff loophole to show how strategic investing can work alongside the RAP plan to potentially save you tens of thousands of dollars.

Understanding the Repayment Assistance Plan (RAP)

The Repayment Assistance Plan is an income-driven repayment plan that will be available to federal borrowers starting July 1, 2026. Its primary goal is to align your monthly payments with your income, ensuring they remain affordable.

Key Features of the RAP plan

The plan offers several advantages that make it an attractive option for federal borrowers. These benefits are designed to provide financial relief and support while you work toward paying off your loans.

Tiered Payment Structure: Your payment is calculated as a percentage of your Adjusted Gross Income (AGI). The tiered system means that as your income grows, your payments adjust accordingly, but they never become unmanageable. If you make $100,000 or more in AGI, your annual required payment is 10% of AGI. The full schedule and range of calculations are below:

under $10,000 = $120 per year

$10,000 to $19,999 = 1% of AGI

$20,000 to $29,999 = 2% of AGI

$30,000 to $39,999 = 3% of AGI

$40,000 to $49,999 = 4% of AGI

$50,000 to $59,999 = 5% of AGI

$60,000 to $69,999 = 6% of AGI

$70,000 to $79,999 = 7% of AGI

$80,000 to $89,999 = 8% of AGI

$90,000 to $99,999 = 9% of AGI

$100,000 or more = 10% of AGI

Treatment of spousal income: If you file your taxes as "married filing separately," you can exclude your spouse's income from the payment calculation. This can dramatically lower your monthly obligation.

Principal Reduction for Dependents: Borrowers with dependents receive an additional benefit. For each dependent, the government makes a direct payment of $50 per month toward your principal balance. For a single individual this equates to a $600 annual reduction of their loan principal if their payments aren't reaching principal.

Interest subsidy: If a borrower's monthly payment does not cover the amount of current interest that accrued since the most recent billing cycle ended, the interest not covered by the borrower's payment is subsidized (i.e. paid for).

Length of time: It is a 30 year repayment plan, but this post is not about staying on this plan for 30 years.

Treatment of remaining balance: If a borrowers goes all the way to the end of year 30 on this plan, the remaining balance is added to their earned income for that tax year.

These features combine to create a powerful tool for managing student debt. However, the true potential is unlocked when you pair the RAP plan with a disciplined investment strategy.

The RAPsidy Payoff Loophole in Action

The RAPsidy payoff loophole is not about avoiding your obligations. Instead, it is a strategy that leverages the benefits of the RAP plan to build wealth while systematically preparing to pay off your student loan balance. It involves making the minimum required payments under the RAP and investing the difference between that payment and what you would have paid under a fixed repayment plan of similar length in time.

Let's explore this with a detailed example.

Jason's Financial Situation

Consider Jason, a borrower with the following financial profile:

Student Loan Balance: $500,000

Interest Rate: 6.50%

Adjusted Gross Income (AGI): $150,000

Tax Filing Status: Single

Income Growth: 3%

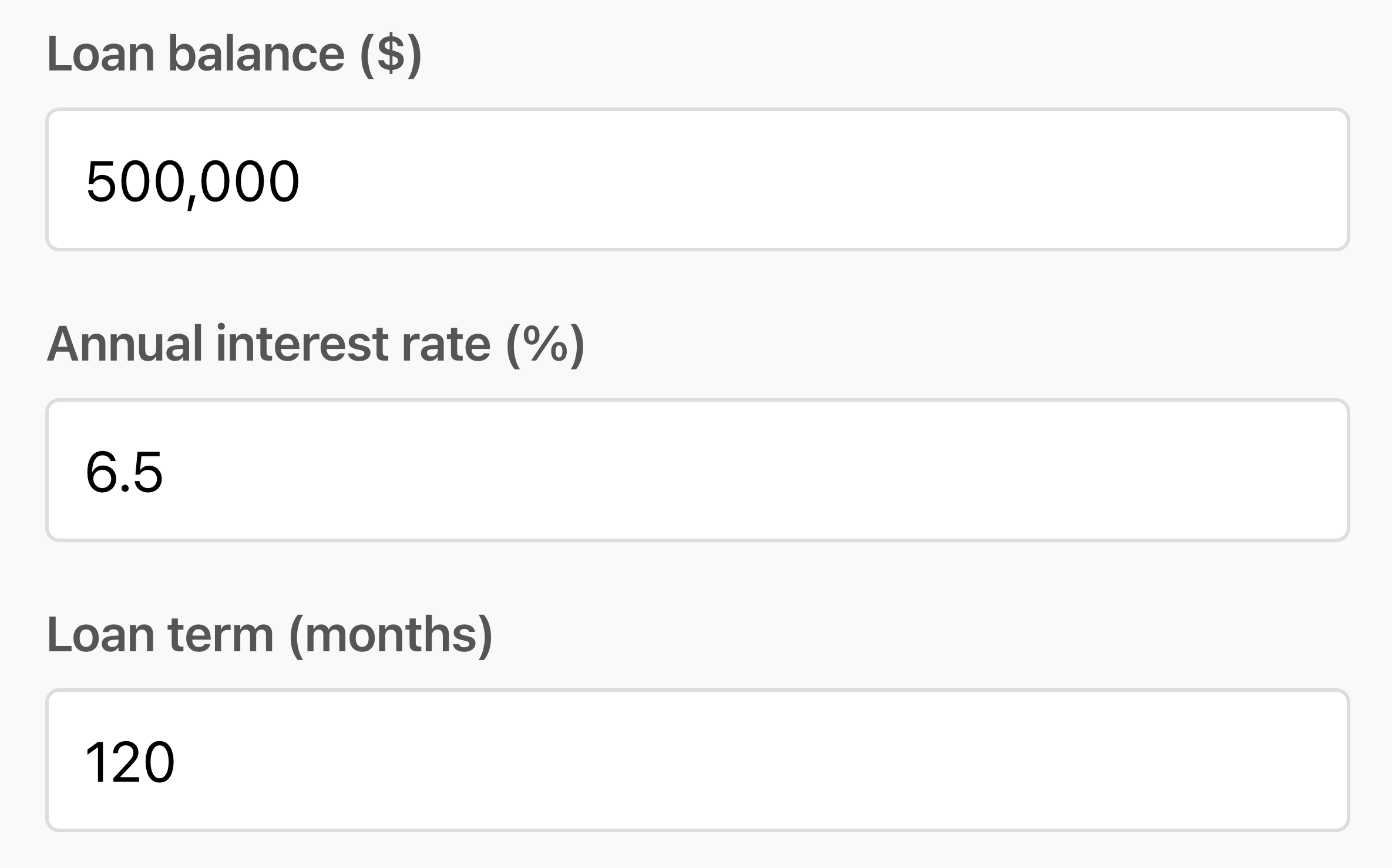

Under a 10-year repayment plan, Jason's monthly payment would look like the below set up:

However, by enrolling in the RAP plan, his financial picture could change significantly.

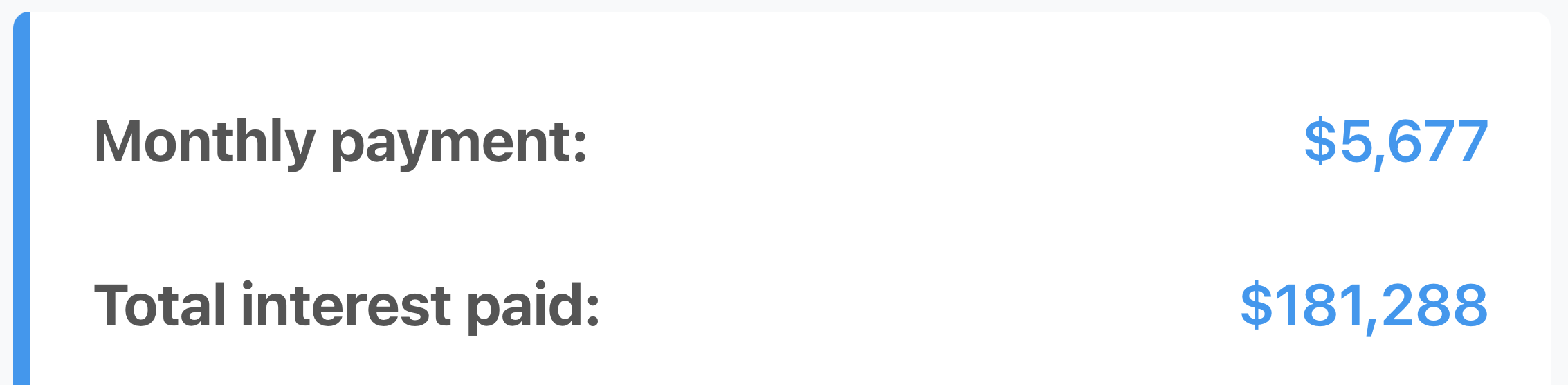

Calculating Jason's RAP Payment

The RAP calculation for Jason’s payment is based on his $150,000 AGI. According to the tiered structure, his monthly payment would be $1,250 for the first 12 months. This is a substantial reduction from the $5,677 per month that he would owe on a 10 year repayment plan.

Here is how the RAPsidy payoff loophole works for him:

Reduced Monthly Payment: Jason pays the required $1,250 per month.

Invest the Difference: The difference between his standard payment ($5,677) and his RAP payment ($1,250) is $4,427. Jason commits to investing this amount every month in a diversified portfolio.

Utilize RAP Benefits: Along the way, Jason's payment is less than the interest that accrues, so the balance does not grow. In fact, the balance goes down by $50 per month through the principal reduction benefit.

The Ten-Year Strategy

Let's track Jason's progress over the first 10 years of this 30 year income-driven repayment plan.

Total RAP Payments: Jason pays $1250 per month for 12 months, then $1288 for the next 12 months since his income went up by 3%, and so on. In total, he'll pay about $172,000 in monthly payments.

Student Loan Balance: Jason's balance is projected to be $494,000 at the 10 year mark after receiving $6,000 in principal reduction at a rate of $50 per month.

Investment Account: Simultaneously, as Jason invests every month. Assuming a 5% after-tax annual return, his investment portfolio grows to approximately $643,000.

The Financial Impact of the RAPsidy Loophole

If Jason had simply paid $5,677 dutifully for 10 years, he would have ended up paying $681,240 in total to the lender.

But if Jason goes the RAPsidy payoff loophole, he could pay $172,000 in payments along the way plus the $494,000 balance ... and have nearly $150,000 leftover in his investment account.

The primary benefit of this strategy is the opportunity for your money to work for you. Instead of sending large payments to a lender, you could be building an asset that grows over time. The interest subsidy provided by the RAP is what makes this possible.

You are effectively redirecting payments from a 6.50% loan turned effective 3.00% loan because of the interest subsidy, into an investment that has the potential to earn a higher return.

Take Jason's payment of $1,250 x 12 months of payments divided by a $500,000 balance that doesn't grow = 3.00% effective interest rate.

By leveraging the RAP plan, you could transform a financial liability into a wealth-building opportunity. While this strategy requires discipline, the potential savings and long-term financial benefits are substantial.

For those with federal student loans, exploring the Repayment Assistance Plan is a critical step. It may offer more than just a lower monthly payment; it could provide a pathway to financial independence. By understanding the rules and pairing them with a professional plan, you can take control of your student debt and build a stronger financial future.

How can you get help evaluating RAP versus other IDR repayment options?

You could follow news and updates on studentaid.gov/, scour Reddit threads, follow our newsletter, or hire us to craft a custom plan and comparison for you.

The great news is that there is time to evaluate your options concerning the RAP plan. And Grad Loan Advice can help if you need it.