Smart Borrowing for Graduate Degrees

A Complete Guide to Student Loans, Repayment, and Loan Forgiveness

Graduate programs open doors for careers in medicine, law, pharmacy, and allied health—but they also come with the weight of significant student loans. With average healthcare student loan debt rising, shifting forgiveness rules, and complex repayment plans, future professionals are under pressure to make smart borrowing decisions from day one.

This guide breaks down each stage of graduate student debt management—from understanding projected earnings to navigating loan forgiveness. You’ll learn to analyze your true costs, compare loan types, develop a repayment plan, and leverage support resources to protect your financial future.

Mapping Future Earnings for Healthcare and Professional Degrees

Facing multiple graduate acceptances is an exciting achievement. Yet every program represents a different financial path, with your future income defining what you can safely borrow and repay.

Estimate your salary before you borrow.

Research the starting and average salaries for your chosen specialty using the Occupational Outlook Handbook.

For example, current median annual wages for physicians exceed $200,000, while mental health counselors earn $50,000-$60,000.

Clinical hours, residencies, or fellowships may delay full earning potential.

Project how quickly your income will rise in the first five years post-graduation.

Why future income matters for student loans:

Your projected salary sets a safe borrowing ceiling (typically, total debt at or below 1.5x your expected starting salary if you plan to pay off the loan in less than 10 years).

Income and your employer shape which repayment and forgiveness programs you may qualify for.

For healthcare fields, long training timelines and varying specialties can make budgeting crucial.

Tip: Use Grad Loan Advice’s loan calculator to match potential debt against future income to understand the total costs of borrowing through the lends of the federal student loan repayment programs.

Calculating the True Cost of Graduate School

The published cost of attendance (COA) often tells only part of the story.

Break down every expense, including:

Tuition and mandatory school fees

Living expenses (housing, food, transportation)

Books, equipment, and exam fees

Loan origination fees (For federal loans issued after October 2020, 1.057% for Direct Unsubsidized Loans and 4.228% for Direct PLUS loans )

Interest that accrues during school (unsubsidized loans and Direct PLUS loans begin accruing interest immediately) at the interest rates published here from the Department of Education.

Example calculation of how $400,000 stated COA becomes $500,000:

If your annual COA is $100,000 and you borrow the full amount in Direct Unsubsidized and Grad PLUS loans:

Origination fees add about $3,600 per year borrowed.

Interest accrues during each year of school; $100,000 at 8% interest will accrue about $8,000 in interest in the first year.

After graduation, your balance could exceed what you initially borrowed by almost $100,000, before you even make your first payment.

Don’t forget scholarships and financial aid:

Scholarships or aid packages can reduce total borrowing, but watch out for competitive scholarships that go away or dramatically change after your 1st year of graduate school.

Loan repayment assistance, or employer sponsorships also change the equation.

See our scholarships for graduate degrees guide for targeted opportunities.

Decision framework:

Weigh schools by their true net price. Start with the COA and increase it by origination fees and accrued interest. Then reduce that gross price by any scholarships or financial aid.

Factor in long-term opportunity costs (lost earnings during schooling, especially for lengthy residencies).

Consider career-specific outcomes (job placement rates, licensing success) within desired locations.

Federal and Private Student Loans Explained

Federal Student Loans

Most graduate students rely on two main types of student loans:

Direct Unsubsidized Loans general limit of $20,500/year but professional degrees often have higher limits of up to $40,500/year; $138,500 aggregate for most health professions; higher for certain physician, dental, and veterinary programs

Grad PLUS Loans currently capped at the stated COA and covers the remaining need, credit-based, no aggregate limit

NOTE from editor: the House Bill called the "One Big Beautiful Bill Act" that has not yet become law indicates a $200,000 lifetime aggregate cap on federal student loans for any one borrower ($50,000 for undergrad; $100,000 for graduate programs; $150,000 for professional programs) a Summary of the Bill

Private Student Loans

Offered by banks and credit unions, these are sometimes necessary if federal limits are maxed out or simply not available to a prospective students like Dreamers (DACA recipients) or International students.

Key Differences:

Interest and Grace Periods

Federal Direct Unsubsidized and Grad PLUS loans accrue interest while in school and the six-month Grace Period immediately afterwards for Direct Unsubsidized loans.

Private loans typically allow for deferment while you’re in school and may also provide options for interest-only or reduced payments during periods of lower income, such as residency or fellowship after graduation.

“Hidden” costs can arise from capitalization of accrued interest (through consolidation or refinancing) once repayment starts.

Pro Tip:

Federal student loans come with borrower protections and forgiveness options that private loans do not. Only select private loans after fully exploring federal options.

Strategies for Smart Loan Repayment

Graduate borrowers have access to several repayment plans. Choosing the right one can save thousands over your career.

Income-Driven Repayment (IDR) Plans

SAVE Plan (replaces REPAYE): Caps payments at 10% of discretionary income; offers forgiveness after 20-25 years, with new interest subsidies for lower earners.

PAYE: Caps payments at 10% of discretionary income; forgiveness after 20 years.

IBR (New Borrowers): Payments at 10% of discretionary income; 20 years to forgiveness.

IBR (Old Terms): Payments at 15%; 25 years to forgiveness.

Income-Sensitive or Income-Contingent: For older loans; less common now but still options for some.

Fixed/Graduated Repayment

Standard 10-year or 25-year fixed payments.

Graduated plans start lower and increase over time.

Useful if your income will rise steadily, but higher total interest.

Estimate your payment:

Use The Grad Loan Advice™ calculator with:

Loan amounts (you can even upload your NSLDS student loan data file to make it real)

Interest rates

Expected income

These tools show monthly payment estimates, timeline to forgiveness, and total projected cost.

Choosing a Plan

IDR best suits borrowers who have lower income for a time or who are seeking loan forgiveness.

Fixed or Graduated plans best suits those targeting rapid payoff and minimizing interest.

Decision tree:

Work for a nonprofit or government? Consider Public Service Loan Forgiveness through Income-Driven Repayment and tread carefully with filing status if married.

Debt balance similar to Expected annual income? Consider aggressive payoff and refinancing.

Expect slow salary growth? IDR plans offer flexibility at first, allowing you to delay the eventual path to commit to.

How to Calculate Total Lifetime Student Loan Costs

Beyond monthly payment calculators, understanding your real cost requires factoring in accrued interest, length of repayment, and potential for forgiveness or refinancing.

Key elements to consider:

Interest capitalization: Interest accrued during school is added to your principal once repayment begins, increasing the amount that accrues further interest.

Total repayments: Add up all projected monthly payments for each plan—including forgiveness timelines and taxes due on forgiven balances (with exceptions for PSLF).

Impact of plan choice: Lowering monthly payments through IDR can result in more total interest paid, unless you receive forgiveness.

Try it yourself:

Use The Grad Loan Advice™ calculator to compare plans side by side. Look for:

Total out-of-pocket payments

Remaining balances at forgiveness

Total interest paid

Any taxes owed on forgiven balances (most federal loans forgiven via PSLF are tax-free, but IDR forgiveness currently may result in a tax bill)

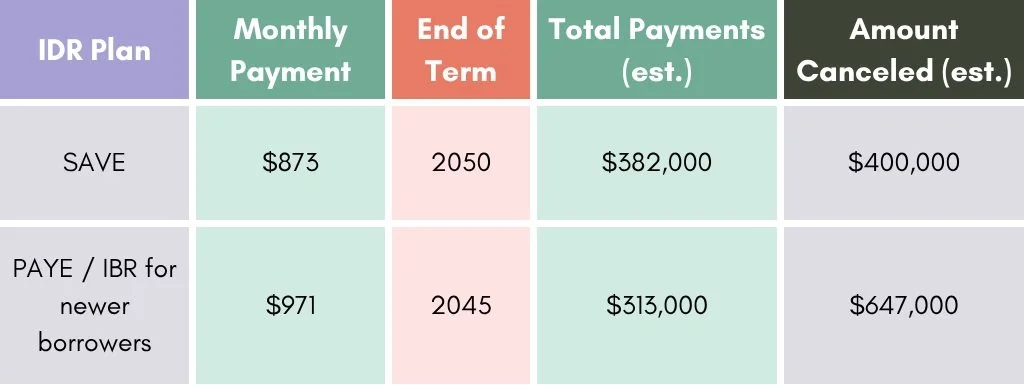

Example Table:

Loan Forgiveness and Debt Relief Programs

Qualified borrowers can dramatically reduce the total cost of their loans with forgiveness programs.

Public Service Loan Forgiveness (PSLF)

Designed for government and qualifying nonprofit jobs.

Requires 120 qualifying payments under an IDR plan.

Remaining balance is tax-free upon forgiveness.

Eligibility hinges on employment, loan type, and correct payment plan.

PSLF Help Tool is crucial for tracking progress.

Other Federal and State Programs:

NHSC Loan Repayment (for primary care, mental health, and dental clinicians)

Teacher Loan Forgiveness (for certain education roles)

State LRP for physicians, nurses, and allied healthcare (eligibility and amounts vary)

Employer programs (e.g., EDRP through the VA, private hospital or practice incentives)

Medical hardship discharge/disability: Federal loans can be discharged for total and permanent disability or borrower death.

Key steps for forgiveness eligibility:

Certify qualifying employment annually.

Ensure payments are under a qualifying plan.

Consolidate non-Direct loans if required, without losing prior forgiveness progress.

Stay updated on program rules; changes may affect eligibility.

Risks:

Late paperwork, missed recertifications, or ineligible loan types can derail eligibility. Avoid common PSLF pitfalls by reviewing the loan forgiveness for healthcare resource.

Should You Refinance Student Loans?

Refinancing is the process of substituting a high-interest federal or private loan for a new, lower-interest private loan.

When to consider:

You have a strong credit profile and stable, high income.

You’re not relying on federal forgiveness or flexible safety nets.

Private loan rates are significantly lower than your current rate.

Pros and cons:

Advantages: Lower rates, reduced total interest, potential for shorter repayment.

Risks: Loss of federal protections (deferment, forbearance, IDR, PSLF eligibility).

Market fluctuation: Rates can change; check studentaid.gov for historical federal interest rate trends before deciding.

Caution: Never refinance federal loans if you plan to use forgiveness, IDR, or want maximum flexibility.

How to shop rates:

Compare at least three lenders, checking both fixed and variable options.

Understand all fees and conditions.

Use online refinancing calculators (see our refinance strategy post) for projections.

When to Seek Professional Help

Major borrowing decisions can have lasting consequences. Often, mistakes arise not from a lack of intelligence, but from a lack of guidance.

Who can help:

Certified Student Loan Professionals: Credentialed experts who specialize in complex loan planning for high-debt fields. Find vetted advisors at the CSLA Board directory.

Grad Loan Advice: Book a personalized consulting session to develop a tailored borrowing and repayment strategy.

How professionals help:

Analyze program costs and financial aid options

Model repayment scenarios using your real-life situation

Alert you to deadlines, documentation, and eligibility traps

Provide ongoing support as you progress in your career

Avoid scams:

Never pay for “forgiveness” that can only be achieved through a federal program.

Consult only credentialed advisors or those with transparent fee structures (see our help page).

A Cautionary Tale:

Ali is a nurse practitioner who took out loans to pay for graduate school. At graduation, she owed $200,000 in federal student loans. The first job offer she accepted was with a university-affiliated hospital.

After talking with a family member who worked at a local bank, she decided to refinance her student loans to get a slightly lower fixed interest rate. In order to get the lowest possible interest rate with the bank, she had to commit to a 10 year term loan which made the payment about $2,000 per month.

After splitting the mortgage and daycare costs with her partner, then paying the student loan payment, there wasn't much leftover to save.

Finishing the loans at year 10 was a massive milestone for Ali. But it left her feeling like she missed a decade of being present in her life and lifestyle. She loved the job. The access she had to cutting edge medicine in an academic hospital was unparalleled. Ali was mostly focused on (finally!) changing her paycheck to max out her workplace retirement account contributions to start building towards retirement now 10 years closer.

Ali shared her experience with a colleague Sara who started about the same time as her. It turns out Sara used an income-driven repayment plan and PSLF to finish in 10 years as well. Sara was planning to step back to work reduced hours. She wanted to travel with her family and do the things they'd been waiting on while the loans were progressing towards a tax free forgiveness date. Along the way, Sara had been putting the same $2000 per month towards a combination of a maximum annual contribution to her workplace retirement account and savings on the side in case PSLF didn't work out. But now, she has a massive head start on Alli and was thinking about the next 20 years in a very different headspace.

With the right advice, Ali's financial path could have looked very different.

Next Steps for Smart Borrowers

Graduate student debt, especially in healthcare and law, is a complex but manageable challenge if you approach it with a plan. Consider your future income, true cost of your program, borrowing options, and the power of forgiveness programs before taking on debt. The right repayment strategy, combined with professional guidance, can turn a daunting loan balance into an achievable financial goal.

Action steps:

Use The Grad Loan Advice™ calculator to test different repayment plans.

Research earnings potential at the Occupational Outlook Handbook.

Explore federal programs at studentaid.gov and reputable nonprofit thinktanks.

Consult with a professional for personalized guidance (book your consult).

By taking charge early and using all available resources, you set yourself up for a secure and rewarding career.

RAPsidy Payoff Loophole: What borrowers need to know

How to use the RAPsidy payoff loophole

How the ‘One Big Beautiful Bill Act’ Overhauled Student Loan Repayment and Forgiveness Plans

H.R.1, now signed into law, repeals SAVE, PAYE, IBR, and PSLF. Learn how this act is impacting borrowers and what steps to take next.

Your Ultimate Guide to Public Service Loan Forgiveness (PSLF)

Answers to PSLF eligibility, application process, and new updates. Maximize your chance for federal loan forgiveness in public service roles.

A Deep Dive into the Income Contingent Repayment (ICR) Plan

Get a clear guide to the Income Contingent Repayment Plan, including eligibility, calculation, and the special role for Parent PLUS borrowers.

Income-Based Repayment (IBR) plan: A Comprehensive Guide

Learn how Income-Based Repayment works, who qualifies, and how it helps keep your federal student loan payments affordable.

How the Pay As You Earn (PAYE) plan works

Learn how the Pay As You Earn repayment plan works, who qualifies, its pros and cons, and how it can lower your student loan payments.

Frequently Asked Questions

-

We are big believers in getting as much homework done as possible, in the moment. So right after a call is scheduled, we ask you to fill out an intake form for your Consultant. We know, from experience, which questions and information about student loans are important and so 10 minutes of work will make your call go so much more smoothly and ensure you get the most that you can from the hour long meeting.

-

Your consultation happens through GoogleMeet. It’s great to make eye contact but if you’d rather go without video, we totally understand. Most of the meeting is a screen-share from your Consultant’s screen to yours. The purpose of the meeting is to identify a strategy for loan repayment that is a best-fit for you. The federal student loans system is not simple or straightforward. If it were either, we would not exist to serve you.

-

Your Consultant will send you a post-meeting email identifying the steps you need to take or the (e)paperwork necessary to head down the path you are committing to with your loans, whether that is a loan payoff or loan forgiveness route. To help with this, your Consultant will provide 1 month of email support in case you run into unexpected processing correspondence with your loan servicer or studentaid.gov

Your Consultant will also provide you with their personal scheduling link if you need to do a follow up consultation later on.